The Galbraith Tables: a New Chapter for Pension Offsetting on Divorce?

Purpose of this article

This article discusses how the thinking on the remedy of offsetting of pension rights has emerged over time, and introduces the ‘Galbraith Tables’, being the authors’ attempt to produce transparent and accessible published tables that are suitable for the valuation of pension rights for such offsetting purposes, and without the instruction of a Pension on Divorce Expert (PODE).[[1]] It discusses some of the issues faced when seeking to compare pension rights with non-pension financial assets, and illustrates that even where consistent assumptions are used, a myriad of valuation figures may still emerge.

Introduction and background

Offsetting of pension rights upon divorce – being the equation of these pension rights to amounts of non-pension capital assets, for the purposes of allowing a fair settlement to be reached – remains a necessary and often deployed remedy, notwithstanding its well-documented drawbacks and the introduction of the pension sharing regime over 21 years ago. There are many cases where the specifics of the parties’ assets and personal circumstances might require such an approach be adopted. It is noted also that the combination of offsetting with partial pension sharing might be deemed appropriate in some cases, but the complexities arising in such situations are beyond the scope of this article.

Nevertheless, the determination of the non-pension capital amount that one might deem equivalent to, say, £10,000 per annum of pension income, payable some 15 years hence and for life thereafter, is far from being an exact science, and different experts might legitimately alight on quite different amounts. This was neatly illustrated by Taylor R & Woodward H, in ‘Apples or Pears? Pension offsetting on divorce’ [2015] Fam Law 1485, where various Pensions on Divorce Experts (PODEs) presented with identical sample cases produced a myriad of possible results.

Such matters were also considered some years earlier in Burrows D, ‘Pensions – How Much to Offset?’ [1999] Fam Law 556, with reference being made to questions of apportionment and the meeting of needs following from the divorce. However, it is fair to say that the thinking has moved on considerably since then; this article predates (but does anticipate) the pension sharing regime that came to be in December 2000, and it relies heavily on the use of Cash Equivalents as valuations of pension rights (discussed later).

Such actuarial considerations associated with the valuation of such pension rights are further complicated by matters pertaining to the comparison of the rights with non-pension assets (including, as appropriate, equity in the Former Matrimonial Home). This – including utility considerations discussed below – is commonly referred to as ‘Stage 2’ in offsetting, with ‘Stage 1’ being the actuarial valuation of the raw pension rights absent such adjustments. In particular, it is generally accepted that it is reasonable to recognise the tax-advantageous status of non-pension monies, being the fact that the holder of such funds – in lieu of monies in a pension arrangement – may produce liquidity that is not subject to the income tax regime.

Nonetheless, it has been noted (in Mathieson G, ‘Pension offsetting: is a consistent approach possible or even appropriate?’ [2017] Fam Law 204 et al) that a ‘formulaic’ approach to quantifying such a discount as might be made for tax is not easily found. Hay, Hess and Lockett likewise noted in Pensions on Divorce (Sweet & Maxwell, 2nd edn, 2013) that ‘there can be no “one size fits all” solution to the offsetting problem. The fair and equitable offset will depend upon a number of factors that will vary from case to case.’ Hay et al also suggested that anything more ‘rigid’ would impede a court’s powers under the Matrimonial Causes Act 1973. Hay, Hess, Lockett and Taylor in Pensions on Divorce (Lexis, 3rd edn, 2018) presented a further revised analysis on the question of offsetting, anticipating the publication of the deliberations of the Pension Advisory Group (for which see below).

More nebulous still is the adjustment under Stage 2 that might be made in respect of utility, to take account of inter alia the accessibility of pension monies in the future relative to other assets now. To wit, how do you value jam now over jam later? Indeed, once tax and utility have been taken into consideration, the range of possible amounts to be used by the courts for offsetting widens further.

WS v WS

Such issues were brought to bear in WS v WS (Financial Remedies: Pension Offsetting) [2015] EWHC 3941 (Fam), [2016] Fam Law 564, and discussed in some detail in Taylor R, ‘Pensions on divorce: another witches’ brew’ [2017] Fam Law 163. In short, no SJE pensions analysis was commissioned – the court disallowing a Part 25 application for a pension expert – and the figure ultimately used for offsetting in respect of the pension rights was derived with reference to the Duxbury tables that are most commonly used for the capitalisation of spousal maintenance.

A number of shortcomings associated with the Duxbury approach in the pension context have been articulated. Particular concern has been expressed about the unsuitability of the assumptions that underpin Duxbury to the analysis and valuation of pension rights. There was an unprecedented and forthright composite response from many of the leading pensions experts of the time, in ‘WS v WS: Pension Experts’ View’ [2016] Fam Law 504, which asserted that a pension income is not an ‘uncertain future income stream’ in the manner of an earned income (which is always subject to the vicissitudes of life) used commonly to fund orders for periodical payments. The jointly-signed article, which reflected the views of most of the key players in the PODE community at that point, noted also that considerations in respect of the Lifetime Allowance pensions tax regime had also been missed.

This was a case where input from a PODE was, in fact, necessary. Even absent this, some more suitable approach than Duxbury might have been used to attach a value to the pension rights being considered for such offsetting purposes.

The PAG Report

In July 2019, A Guide to the Treatment of Pensions on Divorce was produced by the Pension Advisory Group (PAG, with the document being colloquially known as the ‘PAG Report’). This document has rapidly become the definitive guide for practitioners in dealing with pensions matters upon divorce, in particular upon how to instruct a PODE, and it was written in the hope that such a document might lead to a convergence in approaches adopted in respect of pension matters on divorce. Explicit reference to it is made in the judgment of HHJ Hess in the case of W v H (Divorce Financial Remedies) [2020] EWFC B10.

Part 7 of the PAG Report covers offsetting in some detail, and suggests that a PODE may be employed to calculate the value of pension rights in a divorce case for offsetting purposes. It makes comments on possible ‘Stage 2’ tax and utility adjustments that may be applicable to any calculated valuation of such pension rights, but suggests that such matters are for the court, to be considered under s 25 (or indeed by the parties themselves).

Appendix U of the PAG Report does however ‘throw down the gauntlet’ for experts in the field to produce tables for offsetting purposes, akin to Duxbury and also the Ogden tables that are used inter alia to capitalise compensation due in personal injury and fatal accident cases. In particular, it notes that ‘it is worth exploring in principle whether there might be some suitable way, using Ogden-style tables, of reaching a better and more appropriate value than provided by the CE [Cash Equivalent] in cases where parties do not instruct an expert’.

Possible approaches to offsetting

The PAG Report sets out a number of different approaches that might be taken in respect of the offsetting of pension rights, and makes clear that there is seldom one definitive correct answer. Paragraph 7.24 thereof discusses inter alia the merits of using Cash Equivalents alongside more bespoke valuations of the underlying pension rights.

As alluded to above, the use of Cash Equivalents for offsetting with reference to defined benefit (final salary) pensions has been widely discredited. While the Cash Equivalents of defined contribution (money purchase) pensions typically reflect fund values – which may be treated in big money cases as ‘money in the bank, but for a tax adjustment’ as per the conclusion drawn by Nicholas Francis QC (then sitting as a deputy High Court judge) in SJ v RA [2014] EWHC 4054 (Fam) – this treatment does not generally extend to defined benefit pensions. Such defined benefit Cash Equivalents reflect solely the amount that the scheme is prepared to pay out to discharge its liabilities immediately – perhaps akin to the surrender value of an insurance policy – and do not usually reflect the full economic value of the underlying pension rights.

Most other expert attempts to value pension rights (at least in defined benefit schemes) will typically discard Cash Equivalents in favour of valuing the underlying benefits that the individual is to receive. This tends to be done with some reference to the ‘open market’ cost of the rights i.e. a determination of the monies that one might need to have today to replicate the pension promise in the scheme, whether this is a benefit in payment at present or one deferred until a later retirement date. The PAG Report introduces the concept of the Defined Contribution Fund Equivalent (DCFE), being the defined contribution funds that a party would need to hold today to replicate the rights provided in retirement by a defined benefit pension scheme. This is sometimes also referred to as the ‘true value’, ‘fair value’ or indeed ‘open market value’ of a pension in financial remedy cases, the final term being our preferred one, on the grounds that it reflects the cost of replicating the promised pension rights with reference to annuity purchase in the open market.

Different approaches depend upon precisely how such rights are to be valued, with two common definitions being:

- The capital values of the pensions to their holders i.e. the value of H’s pensions to H and W’s pensions to W; and

- The cost associated with making up the shortfall in income for the party with the lesser pension rights i.e. the value of H’s pensions to W less the value of her own pensions.

This is analogous to pension sharing approaches that equalise capital values and those that equalise incomes in retirement.

The Galbraith Tables

We hereby introduce the Galbraith Tables, which may be used by practitioners in seeking to value pension rights for offsetting purposes on divorce, with the remainder of this article being devoted to the detail thereof and a discussion thereupon. However, this is very much an abridged version of the commentary that accompanies these tables, which is to be found at https://tinyurl.com/2tj4z7fc.

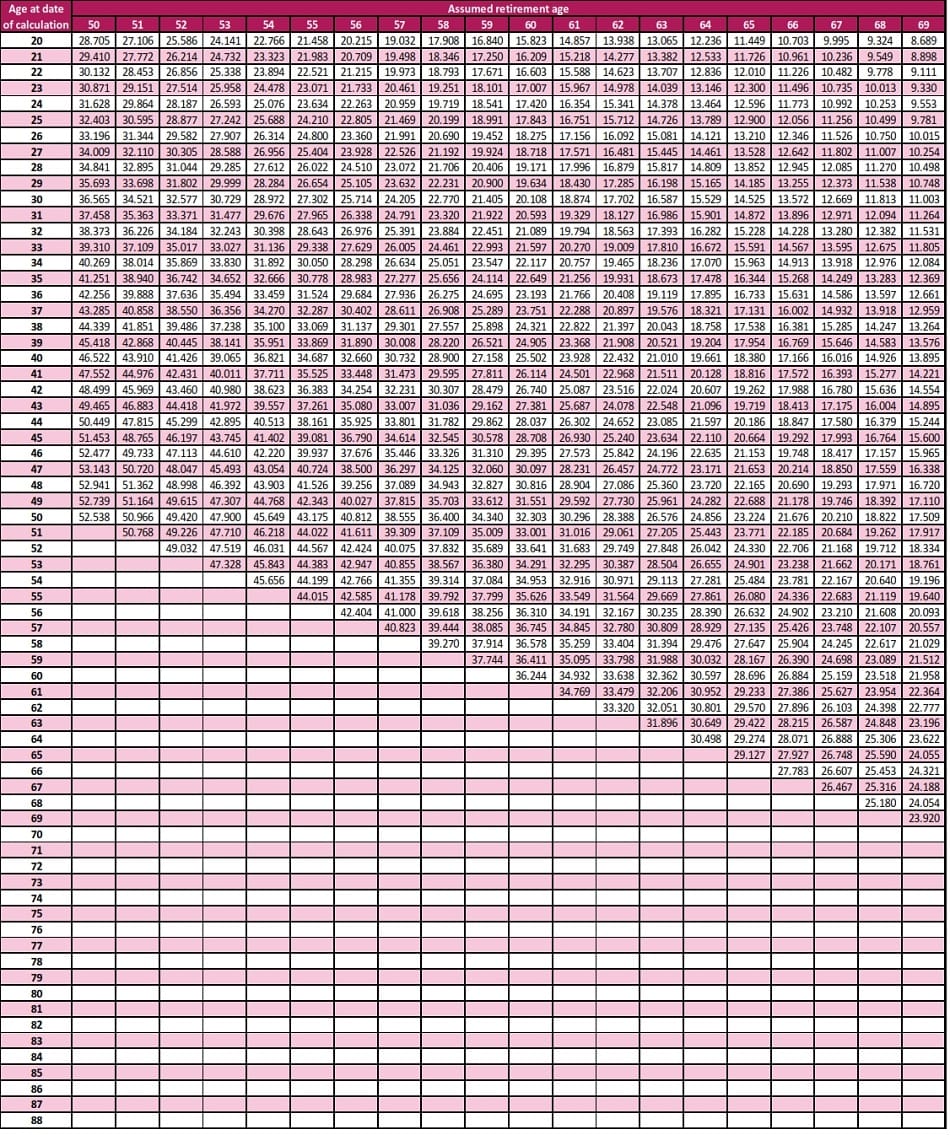

These tables are intended to provide a suitable answer to the ‘Stage 1’ question of how to value a given per annum pension, payable either at present or at a later date, and likewise in respect of lump sum amounts payable upon retirement. In this way, they provide a measure of what the PAG Report called the DCFE. The tables are produced in a similar manner to Ogden and Duxbury. It is our ambition that these ‘Galbraith’ Tables may be adopted by practitioners in this area of law. The Galbraith Tables provide the user with a figure that is to be multiplied by the pension rights being valued. Importantly, the assumptions that underpin the tables are transparent and clearly stated, which allows the figures in these tables to be reproduced and scrutinised.

In particular, the Galbraith Tables rely upon:

- The accumulation of funds in the period to retirement with respect to what we believe to be ‘best estimate’ investment returns, using net rates of -1.00% to 3.00% p.a., dependent upon the term to retirement and with lower rates being used the closer one is to retirement. This is in comparison to the 3.75% p.a. net rate used by Duxbury. The use of a negative net rate allows for returns on lower risk investments (e.g. cash at bank) being outstripped by price inflation, and overall the investment strategy adopted is intended neither to be too prudent nor too risk-seeking. In particular, these assumed rates of return were set with reference to the projections that leading pension providers make when producing Statutory Money Purchase Illustrations (SMPIs), with these being annual projections of what a pension fund might be worth at retirement that are provided each year to scheme members.

- The decumulation – or amortisation – of funds at retirement with reference to a prudent ‘income drawdown’ strategy, intended to produce income amounts that might be deemed similar to those associated with annuity purchase at retirement. In particular, the tables assume that a 60-year-old might need c.£33–36 at that point to secure £1 p.a. of lifetime pension income.

In terms of the assumptions made, it is recognised that there are many ‘right’ answers, and that absent a detailed analysis of the wider context of any settlement, parties’ attitudes to risk, their expectations of future market conditions ad nauseum, it was necessary to derive something that might be deemed to be an acceptable, workable and reliable ‘broad brush’ approach. It is one that we believe to be both easily reproducible and readily justifiable.

The premise of explicit annuity purchase at retirement was rejected for the purpose of producing the tables, not least on the grounds that annuity rates depend upon the vagaries of pricing strategies, cashflow needs of insurers and allowances for socio-economic factors pertaining to the purchaser (often known as ‘postcode analysis’). However, the assumptions made in respect of life expectancy and post-retirement investment returns are intended – at least in broad terms – to reflect those that might be used by annuity providers.

The pensions tables – but not those in respect of lump sums, which make no assumptions in respect of future life expectancy – are sex-specific, i.e. there are different tables for males and females. This provides an additional level of flexibility – and indeed replicates the approach taken in both Ogden and Duxbury – and seeks to recognise that per annum pension benefits payable to females might be deemed to be slightly more valuable than those payable to males on grounds of the former’s enjoying better overall longevity than the latter. However, such sex-specific considerations may easily be overridden by taking the average of the male and female factors.

The standard tables also assume that pension rights to be valued are linked to the Consumer Prices Index (CPI) measure of price inflation both before and after retirement, but details are provided as to how one might allow for other such forms of indexation. Full details of the assumptions made are shown in the accompanying document, again to be found at https://tinyurl.com/2tj4z7fc. The accompanying document also provides details on how to allow for some of the complications that exist with UK pensions, including defined contribution funds, the presence of guaranteed annuity rates and other benefit promises.

Notwithstanding all of the above, the tables are intended to provide suitable valuations of pension rights before any adjustment in respect of tax or utility is to be considered: it remains the case that such adjustments depend very much upon the facts of the case beyond the pension rights themselves. However, we believe that such tables provide a very useful starting point for practitioners who are seeking to quantify pension rights versus other assets in a broad sense, prior to engaging a PODE, or indeed to determine whether any such appointment is necessary.

Some worked examples using the Galbraith Tables

We suggest that some examples of how the tables might be used will prove helpful at this point. In the first instance, we shall assume that H (age 45) has an accrued pension of £10,000 p.a. that is payable at age 60, with this pension being index-linked with reference to CPI both before and after retirement. This information is likely to be found on an annual benefit statement produced by the scheme, or it might be taken from a Cash Equivalent statement (even where the actual Cash Equivalent value is not itself used).

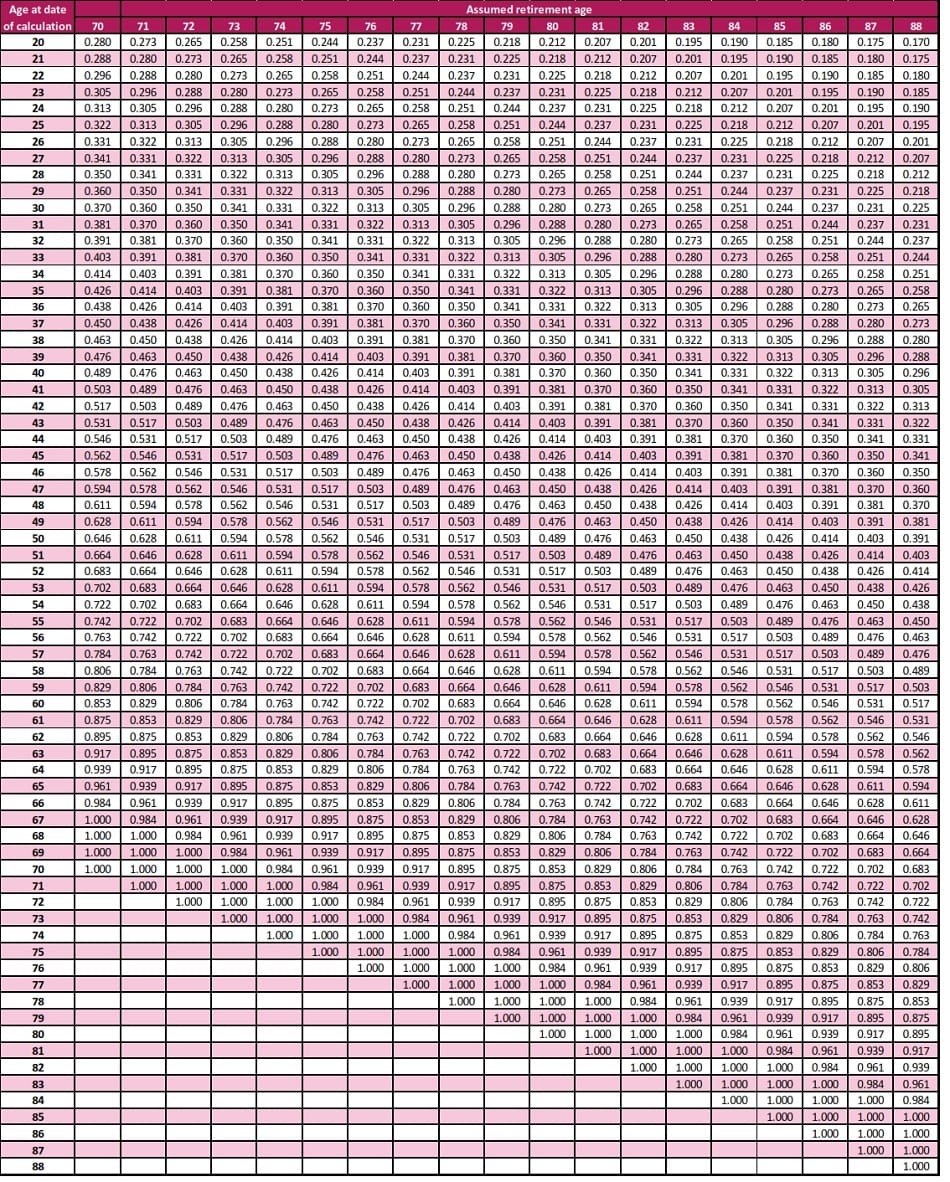

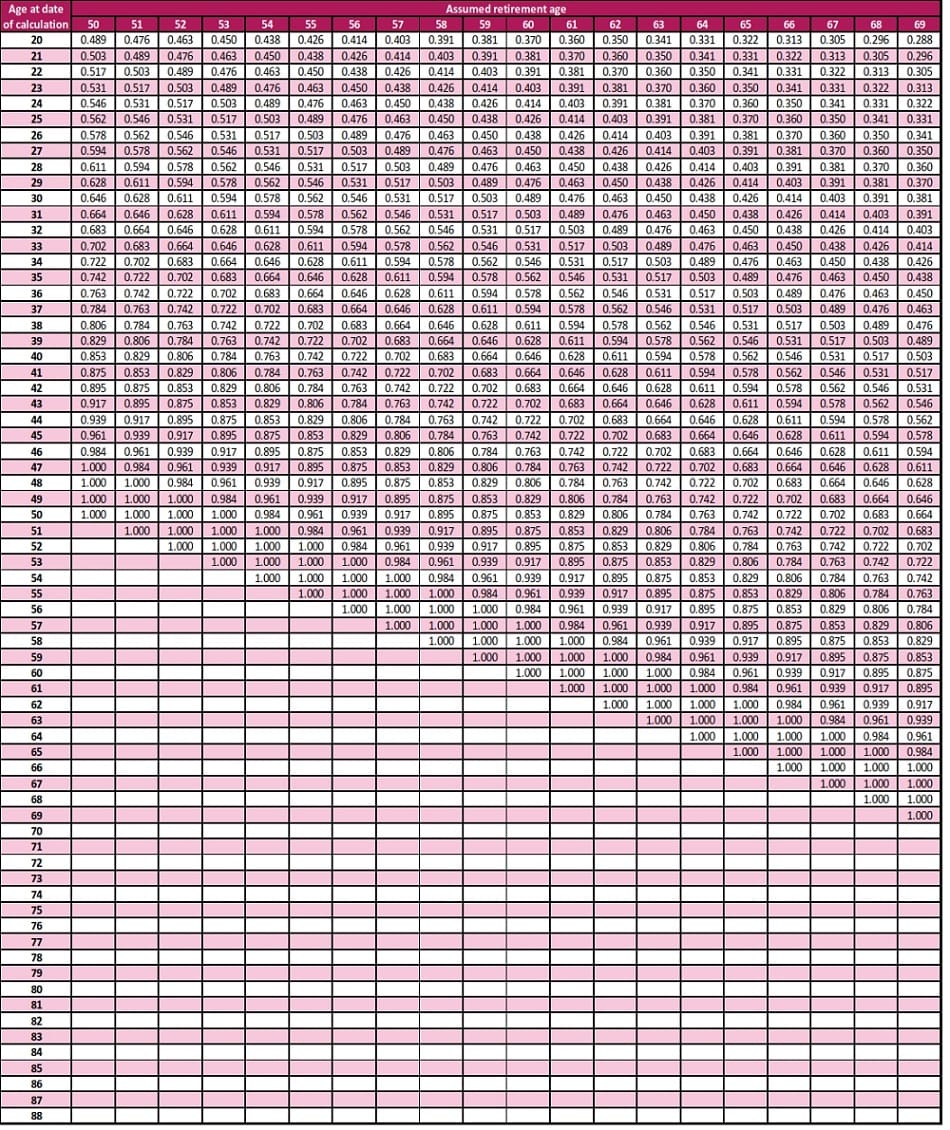

The Galbraith Table ‘Factors used for the valuation of pensions payable in retirement (males)’ shows a figure of 26.230 for current age 45 and retirement age 60 that we use to value the pension rights, and thus 10,000 × 26.230 = £262,300 i.e. we determine that H would require c.£262k today to replicate his pension rights in retirement. This is the raw valuation before any ‘Stage 2’ tax and utility adjustments are made.

Extract from the table is as below:

This figure is the value of the pension to H himself, i.e. the capitalised amount of his pension rights. It follows that the cost to W to replicate such an income (i.e. the value of H’s pension to W) would differ where there is an age difference between the parties, not least on the grounds that the period to retirement over which monies may benefit from investment returns would vary.

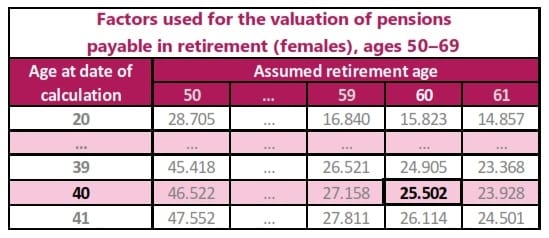

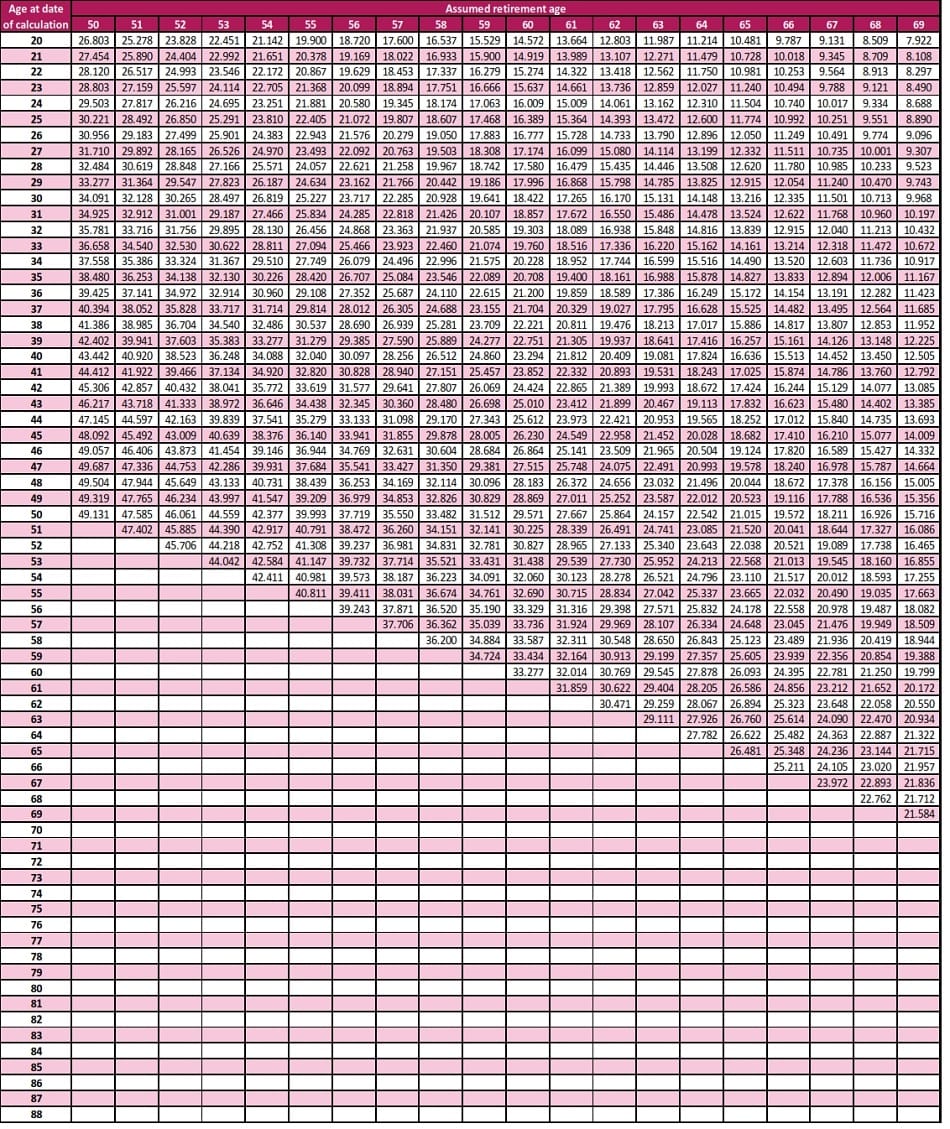

Thus if W in the example above is aged 40 – five years younger than H – it follows that we refer to the other Galbraith Table ‘Factors used for the valuation of pensions payable in retirement (females)’, which gives a figure of 25.502 for current age 40 and retirement age 60, and thus 10,000 × 25.502 = £255,020, i.e. W might only need c.£255k to replicate such pension rights in retirement. Again, this is the raw valuation before any tax and utility adjustments are made.

Extract from the tables is as below:

Such an example takes us back to one of the key issues associated with offsetting, being what is meant by such a term. Offsetting with reference to the capital values of pensions for their current holder may well differ from what the other party requires to match the pension rights in retirement.

Moreover, this pension will also have a Cash Equivalent available from the scheme administrators, which will reflect the assumptions set by the scheme trustees on the advice of the scheme actuary, and will differ from what is determined above. As alluded to earlier, Cash Equivalents tend to understate the costs associated with securing pension rights: were H to request this from the scheme, a figure of perhaps £200k might emerge in respect thereof. However, it should be noted that some private sector defined benefit schemes do provide much more generous Cash Equivalents, with there being a significant range in the generosity of such transfer-out terms. This inconsistency in the valuation of pension rights from scheme to scheme again renders Cash Equivalents of limited value for such offsetting purposes. As shown above, the Cash Equivalent plays no part in the analysis of rights that relies on the Galbraith Tables.

As alluded to in the PAG Report and elsewhere, still further approaches may be adopted in respect of offsetting. It is important to recognise why different offsetting amounts in respect of the same pension rights may emerge, and this is an important consideration for practitioners when looking to instruct a PODE. All too often it is easy to receive back an expert witness report that shows figures under, say, four unique methods, then subject to a rough tax adjustment and then a (somewhat spurious) utility adjustment, where the reader is then left with a vast range of possible ‘acceptable’ answers.

While recognising this, we respectfully question the approach suggested by Crowley P, ‘Pension Offsetting on Divorce – A “Navigation” Process’, Expert Witness Journal, April 2021, where it is deemed suitable to take an average of the figures that might emerge from such different measures. His article provides some detail upon how defined benefit Cash Equivalents are calculated, but we take the view that such an approach to the derivation of a single offsetting figure loses the subtleties that arise under different valuation methodologies. Moreover, the averaging of such market-implied figures as might emerge above (whether via the Galbraith Tables or some other DCFE/true capital value measure) with a typically much lower Cash Equivalent is expected to provide an alluringly simple figure which may be open to challenge upon careful reflection.

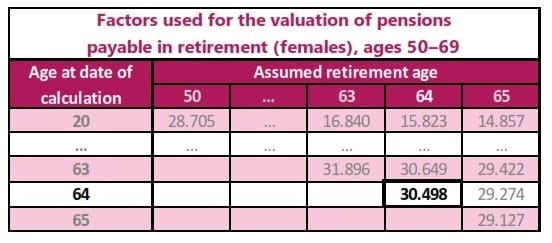

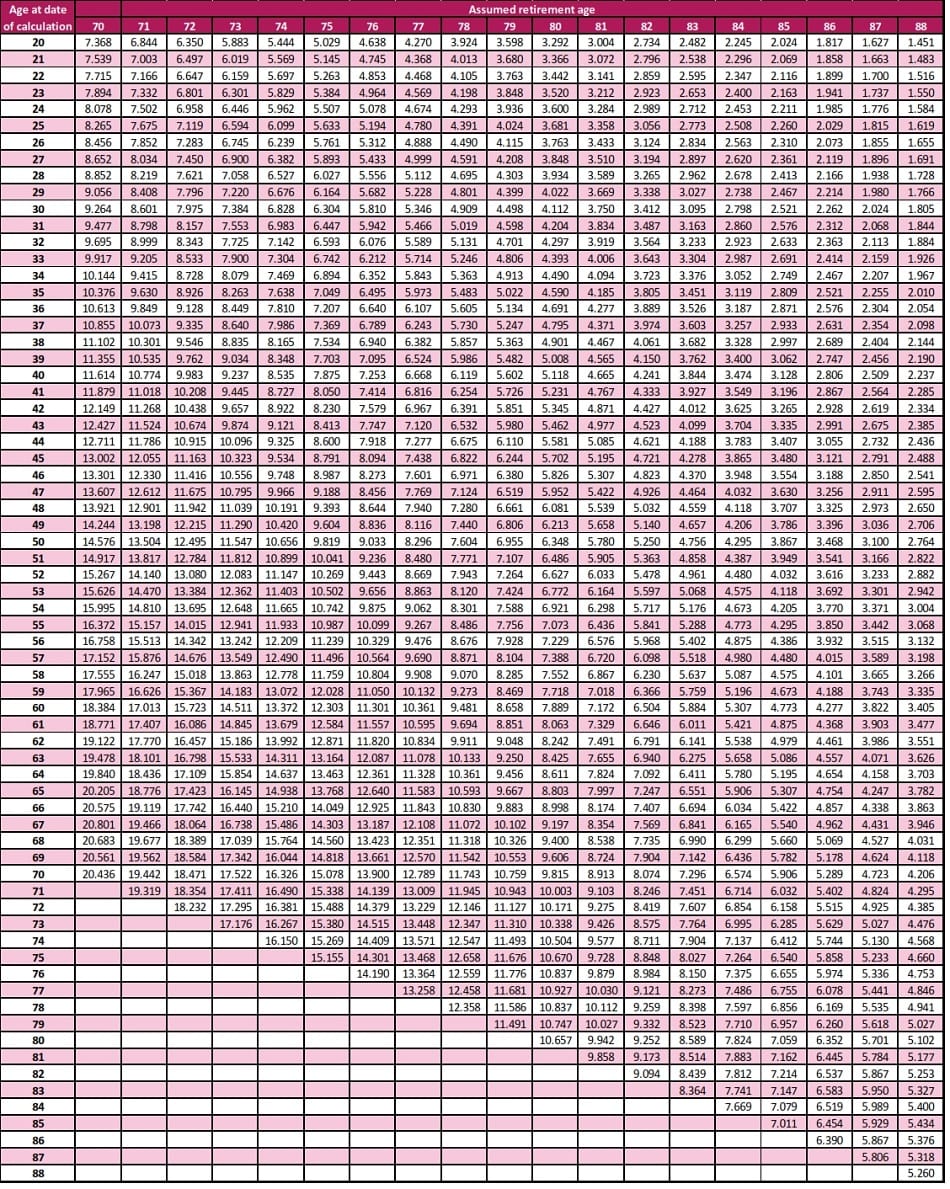

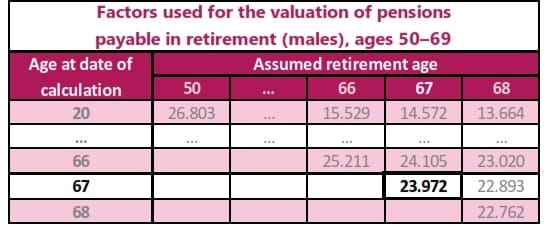

Let us now consider another example: suppose that H is aged 67 and W aged 64; he has a pension income of £25,000 p.a. and she one of £11,000 pa, with these now being in payment. On a capital measure, and with reference again to the tables, we value the pension rights of H in excess of W as 25,000 × 23.972 – 11,000 × 30.498 = c.£264k, while on an incomes measure the calculation becomes (25,000 – 11,000) × 30.498 = c.£427k.

Extracts from the tables as below:

In layman’s terms, when we simply look at the difference in pension incomes and ‘how much W is short by’, we use the 30.498 factor applicable to her at age 64. By contrast, when we value the pensions on a capital basis, we instead value H’s pension using the 23.972 factor that applies to him at age 67. It can be seen that the cost to provide W with each £1 per annum of pension is higher than it is for H, given the three-year age difference, and in turn she requires a larger amount of non-pension capital to match his pension income today than simply to replicate the rights that he himself enjoys.

Further examples are to be found within the Galbraith Tables document itself.

Conclusion

It is to be hoped that the simple examples above demonstrate the ease with which such high-level offsetting figures may be determined in respect of pension rights, and that this will be of benefit to practitioners. It is to be noted that i) such results are by no means definitive, and other figures may well be deemed to be acceptable; and ii) the subtleties and intricacies of all too many UK pension arrangements continue to make it imperative that the support of a PODE is sought.

In particular, where considerations pertaining to partial offsetting, Lifetime Allowance issues, apportionment of benefits, ‘unusual’ private sector defined benefit schemes amongst many others are to be entered into, it is noted that there is no substitute for the seeking of professional advice from suitably-qualified PODEs. Nevertheless, we believe that the Galbraith Tables can be deemed ‘good enough’ for the purposes set out above, and may bring considerable value to practitioners in dealing with the ever-complex question of how to compare pension rights alongside other financial assets upon divorce.

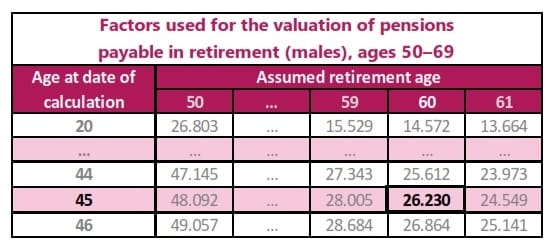

Factors used for the valuation of lump sums payable at retirement (either sex)

Retirement ages 50–69

Retirement ages 70–88

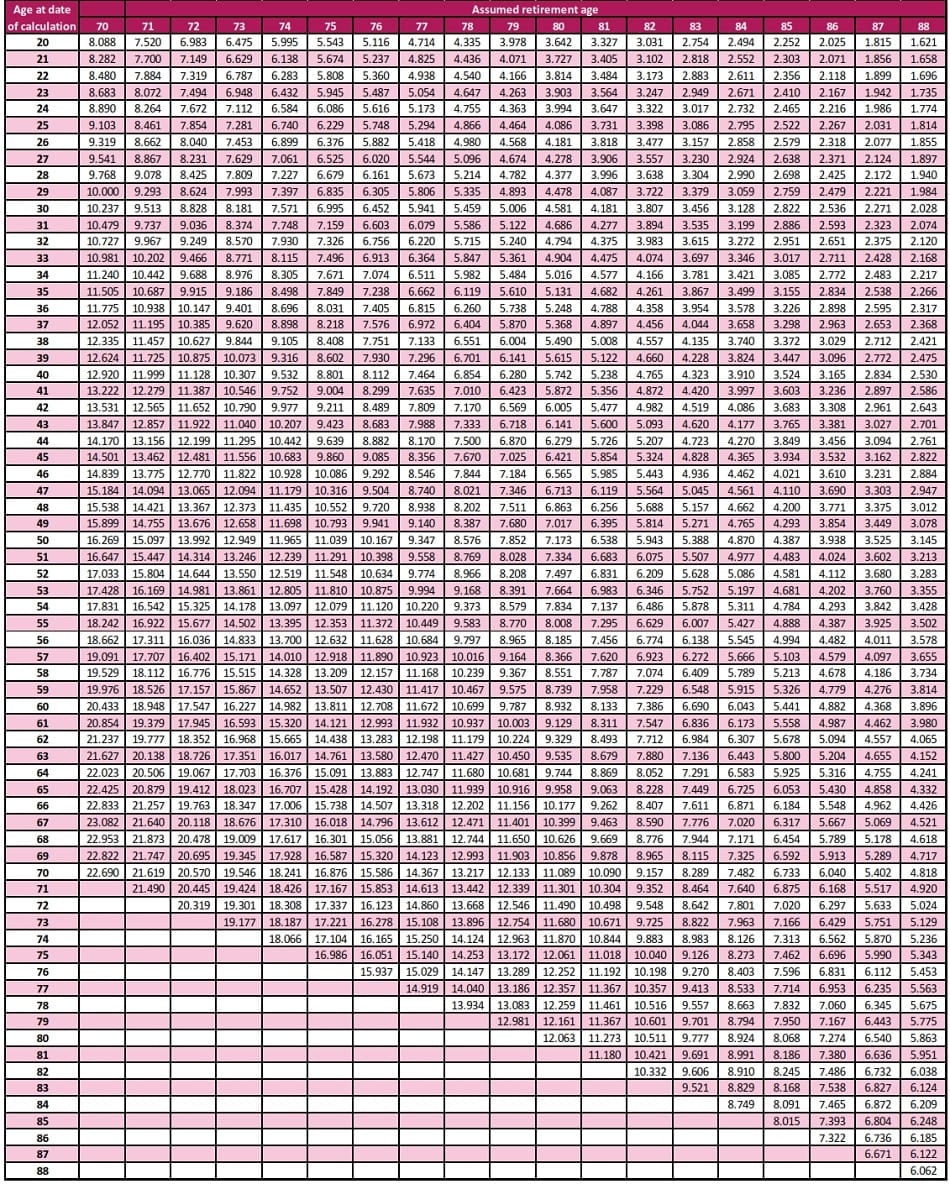

Factors used for the valuation of pensions payable in retirement (males)

Retirement ages 50–69

Retirement ages 70–88

Factors used for the valuation of pensions payable in retirement (females)

Retirement ages 50–69

Retirement ages 70–88

[[1]]: This term – and associated acronym – has now entered the lexicon as a shorthand for pensions professionals who provide expert witness services with respect to pension assets in financial remedy proceedings. Many PODEs are qualified actuaries – including the PODE authors of this article – but this is not an explicit requirement to practice in this field.