Tech Corner: Miris Reporting – Innovative Technology to Help Solicitors Prepare, Verify and Negotiate Client Housing Needs

Published: 21/05/2025 10:00

Introduction

This article reviews how solicitors currently fulfil the filing requirements of the 2022 Statement on the Efficient Conduct of Financial Remedy Hearings in the Financial Remedies Court below High Court Judge Level (the Efficiency Statement). It documents the specific challenges of producing indicative borrowing capacity material, going on to describe how new technological innovation from Miris Reporting will improve this through transparency and standardisation. Lastly, the article considers how technology can bring mortgage capacity, mortgage sourcing and property finding together, to improve the efficiency and effectiveness of negotiating housing needs for both non-court dispute resolution (NCDR) and in court.

Overview

The idea for Miris started with a long overdue catch-up with six family lawyer friends and red wine (well, let’s be honest, many new business ideas start this way). It had been 6 years since I had sold my family law service business, Novitas Loans, and I wanted to learn how the family law world had evolved and changed in that time. The conversation ultimately focussed on two things: the drive to improve the efficiency of financial remedy court hearing proceedings and the growth in use of NCDR.

It was explained that in January 2022, Mr Justice Mostyn and HHJ Hess introduced their Efficiency Statement.

Contained within that statement was the requirement that each party, 14 days before the First Appointment, use their best endeavours to ‘file with the court jointly obtained brief indicative material as to their respective borrowing capacities’ (emphasis added).

It further states that ‘if obtaining such material has proved impossible, the parties should individually use their best endeavours to obtain and file such material (this material will not preclude the parties from later seeking to adduce formal evidence of this nature)’.

The drive for efficiency at the First Appointment stage and the increased use of NCDR were clearly both exciting initiatives and a positive step forward. Listening to the solicitors talk, however, it became apparent that the requirement to file further additional material before the First Appointment can result in increased legal fees for clients.

For example, they described the challenges from non-standardisation of mortgage capacity reports, or the regular back-and-forth with experts on even basic mortgage-related questions; all this contributed to delays and additional cost for the client.

It was apparent that the industry had simply not kept pace with the evolving needs of the solicitors and judiciary; the situation needed a technological solution. If a solution could be found to provide solicitors with an interactive mortgage capacity tool and access to information such as live mortgage data, it could step change the effectiveness and operational efficiency of how a law firm delivered these requirements.

The judiciary had set a clear direction – industry now needed to step in and provide the platform. This led to the creation of Miris Reporting.

NB: Since the initial solicitor meeting, Miris has met with a further 50 solicitors and barristers, the information from these meetings informing the development of the MIRIS platform.

Current approaches to indicative mortgage capacity reports

If we start with a review of indicative mortgage capacity reports, we could surmise two main approaches used in their creation:

- Client-produced evidential material: these are varied but can take the form of a short email from a ‘friend who is a broker’, to a print-out from a bank’s website where some very basic information had been provided. These tend to be limited in nature and often incomplete, for example not including monthly mortgage costs.

- Regulated mortgage broker reports: the client visits a mortgage broker who typically produces a standard letter with perhaps a paragraph or two dedicated to the client specific circumstances.

Solicitors are unsure what information the client has shared with the broker, is it complete and accurate, in line with the Form E? Solicitors may write a directions letter to the broker and regularly require one or multiple follow-ups with the broker, to get to the right answer, i.e. the one they finally wish to present as best meeting the needs of their client. All these steps take billable time (from both solicitor and broker), meaning the actual cost to the client of the report is well above the headline report price of £200–£500.

There is clearly a time and cost balance to be struck in producing a borrowing capacity that is indicative, but one which is also reflective of the client’s actual capacity, and therefore useful. But does either approach achieve this balance? It is time to introduce the concepts of transparency and standardisation.

We need more transparency

At this point some mortgage-specific context is required. Broadly, a mortgage company calculates borrowing capacity by looking at key client facts (age, employment status, credit history, etc) and applying a percentage to their surplus income (difference between income and expenditure).

If the borrowing capacity report is not transparent, i.e. does not contain the detailed breakdown of key client information and what income and expenditure has been applied, there is going to be uncertainty as to the reliability of the borrowing capacity. This is unfortunately quite usual, especially when solicitors take a strategic approach to sharing what actual underlying information was used to create the borrowing capacity. Without transparency it is very hard to attribute an associated level of confidence with the numbers being put forward.

We need standardisation

Currently, there is no standardisation in how borrowing capacities are presented. Every client and broker utilise their own format, with varying levels of information and completeness. This means solicitors, barristers and judges are always having to interpret different documents, making assumptions as to the accuracy of the numbers presented, thus making their jobs harder.

The logical outcome is a lack of trust by the solicitor of client-produced evidence, or more commonly between parties. Solicitors told us they would get an indicative report and regularly say ‘how on earth did they get to that number?’ or ‘that’s a nonsense, I bet they haven’t included retained profits’. Consequently, further time and expense are incurred challenging the report and/or in the commission of a shadow report. These shadow reports are increasingly common and are in effect doubling the cost across the proceedings.

Proposed new indicative borrowing capacity report

It must surely be beneficial therefore for all parties to use the same style report, delivering standardisation, and to achieve transparency by each report containing key information such as:

- Client details (type and length of employment, planned retirement age, credit situation such as any active CCJs, dependants, etc).

- A detailed list of income and expenditures, showing how the surplus income used in the mortgage capacity calculation has been accomplished.

- Their actual borrowing capacity and associated deposit level to achieve the maximum level of affordable property.

- Mortgage product examples, with fees and monthly costs both during and after any offer period.

Inclusion of property particulars

There is also much sense in extending the borrowing capacity report to further include property particulars. When negotiating housing needs, the mortgage capacity, mortgage product details and suitable housing all flow together, one leading the next.

Currently, solicitors are searching on Zoopla or Rightmove looking for properties or chasing clients, then using Google to try to calculate travel distances and times.

For ease and efficiency, it seems logical to include property within the same mortgage capacity report as each component is intrinsically linked. This would also allow solicitors to meet a further requirement of the Efficiency Statement, namely ‘to file with the court and serve on the other party no more than 3 sets of property particulars showing what their case is likely to be on housing need for themselves and the other party’.

The technology opportunity

We need to recognise that the current approach to indicative borrowing capacity (and, by extension, to NCDR proceedings involving property needs) operates in this form due to the unavailability of suitable technology.

Solicitors simply don’t have access to tools to calculate mortgage capacity or see available mortgage products to know if and what their client can qualify for. They don’t have any way of preparing their own client scenarios, for example change an expenditure, such as paying off a car loan, and see in real time the impact on mortgage capacity, availability and price of an available mortgage product, and the impact on examples of suitable housing. They also have no way of producing their own indicative borrowing capacity reports.

Solicitors have been forced to rely on third parties with their inherent costs and delays.

If technology, for the first time, could put the tools into the hands of the solicitor, the advantages are compelling:

- Greatly improve efficiency: solicitors, barristers and judges can review the same style of report for all clients. It would remove the need for clients to visit a broker, or for solicitors to have multi-interactions with third parties, on basic mortgage related matters.

- Increase trust: having all key data, including detailed income and expenditure, clearly laid out, showing how the borrowing capacity has been arrived at, would give confidence in the numbers or allow for informed challenge, limiting the need for shadow reports.

- Remove constraints: it would allow the solicitor to investigate numerous different scenarios before settling on the best one to move forward with, with no constraints as to the number they can prepare.

Combined, this will meet the goals of increasing the operational efficiency of both the law firm and financial remedy proceedings, ultimately driving down the cost to the client.

The Miris technology solution

The goal of Miris is to bridge this technology gap. Miris has designed and built a unique online platform for solicitors, using a combination for proprietary and proven technology. It provides a live interoperability between mortgage capacity, mortgage sourcing and property selection. Solicitors now have a tool that allows them to prepare client scenarios, verify the other party’s mortgage claims and use in live negotiations.

The Miris platform has three main functions, allowing a solicitor to:

(1) Calculate a client’s mortgage capacity

Build up a client’s list of income and expenditures, include a second party or a cohabitee/partner. Add key information such as retirement age, credit history and available deposit.

The platform then automatically calculates the client’s mortgage raising capacity and associated deposit requirement.

Changing any factor, e.g. repayment of a loan, will automatically update mortgage affordability and associated fields such as deposit requirement; immediately see the impact of decisions/offers.

(2) Run live mortgage searches

Normally only available to mortgage brokers, Miris has created a unique partnership with twenty7tech, the United Kingdom’s leading whole of market mortgage search engine (used by over 18,000 brokers in the United Kingdom). As a result, the Miris platform:

- instantly searches ‘whole of market’ mortgage providers to return details of available mortgages with their monthly costs, fees and any charges;

- displays mortgages with 2-, 3- and 5-year offer periods with monthly cost both during and after any offer period;

- carries over any changes in affordability calculations so you immediately see updated mortgage availability and pricing.

As a consequence, the mortgage product data is always current, solicitors are not referencing products in an historical report that may no longer be available.

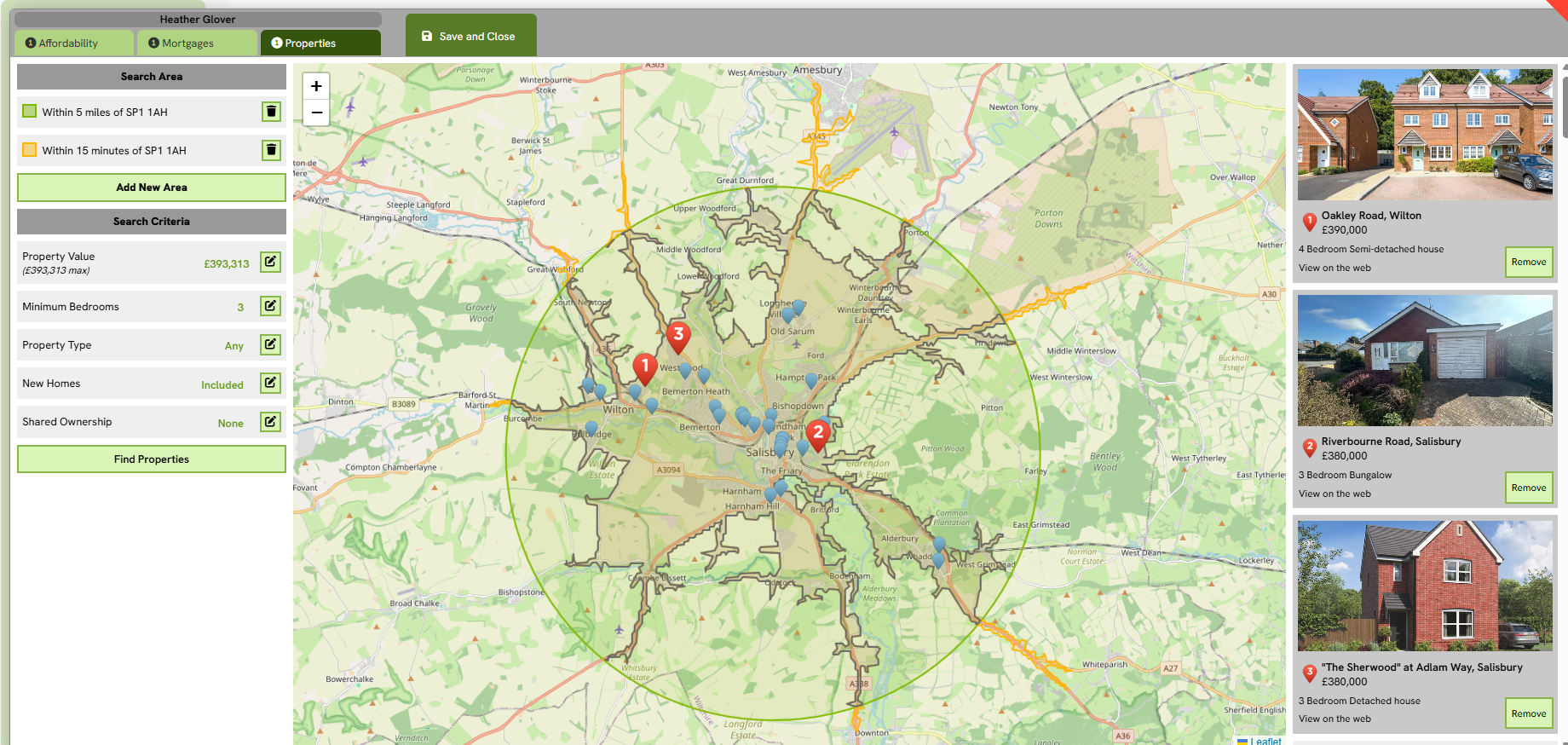

(3) Search for suitable property

Miris has partnered with Zoopla and other specialist technology companies so solicitors can set the area for a property search using multiple factors:

- distance from a postcode;

- travel times to a postcode using transport methods at different times of days.

These can be overlaid to narrow down the target area for the property search. Lastly, it also allows the user to add property characteristics such as number of bedrooms to then show all available properties, shortlisting the most suitable.

Seamless integration with the Miris mortgage capacity and deposit calculation means the data pre-populates the property search. Suitable properties can be shortlisted at the push of a button and added automatically into the report.

Figure 1: Property search function on Miris platform

The Miris mortgage capacity report

Once a scenario is complete (mortgage capacity, product examples and property particulars), the system will generate a mortgage capacity report at the push of button, one that is clear, concise and complete, perfect for use with clients, the other party or filing with the court. All the key information previously outlined is included.

Figure 2: Extracts from Miris mortgage capacity and property report

This report can be for one or both parties, meeting the preferred position of the Efficiency Statement that respective borrowing capacities should be jointly obtained.

Further, there is an option to produce a report just showing property particulars for the other party, everything can be done from the one platform.

By adopting the Miris platform, the solicitors and courts will have a standardised report format, one that provides transparency, and which allows solicitors to meet the requirements of the Efficiency Statement in the most operationally efficient and cost-effective way possible.

NCDR and court proceedings

In designing the Miris platform to improve mortgage capacity reporting, we believe the platform can also dramatically improve how NCDR providers and the courts consider and determine housing needs.

Currently, a mortgage report cannot be queried. In practice, solicitors want to be able to ask many ‘what if?’ questions before settling on their preferred scenario to take forward on behalf of their client.

That is why, on the Miris platform, solicitors can run as many scenarios as they like; for example, input different retirement ages, deposit amounts and maintenance levels, the mortgage capacity and available products will change in real time in response.

A goal of Miris is to put the tools in the hands of the mediator, arbitrator, PFDR judge; allow them to see in real-time the impact of proposals, or suggested changes, and whether a mortgage would be available and its cost. Imagine how much time would be saved and how much more effective meetings would be if those tools were always to hand.

The role of the broker

In this article we have explained why we believe that brokers are over-used at the First Appointment stage, incurring delays and cost. However, we recognise that the system-generated report meets a specific need. When cases have a certain level of complexity, such as offshore assets or multiple company ownerships, it is advisable to go straight to a broker. Furthermore, there will be times, for example, where directions are made by the court, or prior to a settlement being agreed, when the services of a regulated mortgage broker will be required or desirable.

To cater for this, the Miris platform directly links with leading mortgage brokers to provide ease of data transfer and communication, improving the efficiency of their involvement.

Current status

At the time of writing, the Miris platform is currently being beta tested by a number of major regional firms for both report production and as a tool for NCDR. It will be live and available when this issue goes to press. In parallel, we are working on further enhancements around collaboration. For example, to allow solicitors to share their client scenarios with third parties such as barristers and judges, and for those parties to be able to rehearse amendments prior to a meeting.

To make it accessible for all clients, Miris will be priced at only £50, a one-off charge when a client is added to the platform. Run as many scenarios as you like and produce as many reports as you like for that single fee.

Summary

The judiciary has set a clear direction for the efficient conduct of financial remedy proceedings. The associated requirement to provide property particulars and indicative borrowing capacity could be improved through greater transparency combined with report standardisation. Through combining proven and proprietary technology, Miris has looked to provide a solution to this issue and, in so doing, allow solicitors and the courts to maximise the effectiveness of the time they spend with the clients.