Money Corner: Did the 2022 Permacrisis Reduce Your Client’s Pension Credit?

Published: 27/03/2023 09:52

2022, a year that we all hoped would usher in a return to normal following the COVID-19 pandemic, turned out to be full of seismic shifts, and it was certainly a stark reminder that the value of investments can go down as well as up. Investors had to face the dual threat of inflation and interest rates rising sharply and both bonds and equities fell sharply in response. To give these historic moves some context, a typical 60:40 stock:bond portfolio fell 17.7% in US dollar terms (Global Developed Markets/10-year Treasuries), which was the worst outcome since 1931. In the United Kingdom, the 10-year gilt total return was –20.1%, the worst since 1974, whilst the US 10-year Treasury fell by 16.4%, the worst (in US dollar terms) since 1788 when the US Constitution was ratified. At its nadir on 27 September, the 30-year gilt in total return terms was down by 52.4%.1

These huge falls were in response to an enormous change in the interest rate environment over the past 12 months (in which the Fed target interest rate (upper end) rose by 4.25%, its fastest rate since 1977–80). To a degree this change was overdue and to be expected following a period since the Global Financial Crisis in 2009 in which money had been virtually free (in September 2021 more than a fifth of the debt issued by governments and companies around the world was trading with negative yields,2 i.e. investors were paying for the privilege of lending to these governments and companies).

We have witnessed a painful re-set of investment assets (including equities) which has wider and longer-term implications for valuing personal investments such as pensions on divorce and also the capitalisation of maintenance payments and cashflow forecasting to inform and advise on post-settlement choices.

It is also worth noting that at the time of writing in January 2023, although 2022 has been a bad year for investors, there is now a higher sustainable level of income on offer from selected fixed income and equity investments now that the re-set is behind us.

As we look ahead to 2023, the overriding fear dominating the investment world is inflation not recession (another departure from the recent past). At 9.1% US inflation for June 2022 was the highest since 1981 and November UK inflation of 11.1% was the highest since 1982. This is another large shift compared to our experience of the past 20 years and it is the primary driver of Central Bank behaviour, which means that further interest rate rises are likely even though inflation now looks to be peaking in the major developed economies. As labour markets weaken further and supply chain pressures ease we expect further moderation in inflation, which investment markets would view as good news. Markets are currently more worried about inflation becoming entrenched, resulting in higher wage demands and ever higher inflation, than they are about growth falling. This is partly because inflation has not been a threat for such a long time and also due to the very real impact that it is now having on all household budgets and our day-to-day lives. This market slowdown therefore has the potential to do longer lasting damage to investor confidence and behaviour.

A good investment partner will not just focus on the investments that we might hold inside an investment ‘wrapper’ (such as a pension) but would also advise on the broader picture. It is impossible not to have been impacted by the current investment environment (even if clients do not consider themselves to be investors) and our experience in the past few years has had a huge and unavoidable impact on the value of assets accumulated during a marriage as well as on sentiment and the way clients feel about investing going forwards.

The cash value of a pension is referred to as the CETV, or Cash Equivalent Transfer Value (aka CETV, CE or CEB), for pension sharing purposes. Pension sharing orders must be expressed as a percentage of the CETV. If pensions are shared on divorce, one party will receive, as a cash payment into a pension of their choice, a percentage of the CETV (except for unfunded public sector schemes, where the spouse of the member may become entitled to a defined benefit pension in their own right). The CETV is recalculated at the point of implementation, so the cash amount is never known in advance.

There are numerous permutations of types of pensions but, in broad terms, there are only two main categories of pensions: money purchase pensions, also known as defined contribution pensions, and defined benefit pensions (e.g. final salary schemes and CARE schemes).

Money purchase pensions are simply investment wrappers, so the CETVs are the value of the underlying assets, less any relevant charges or penalties. The CETVs fluctuate in line with the investments selected, and therefore investment markets more generally.

However, the situation is markedly different for defined benefit pension schemes.

Defined benefit pension schemes CETVs (DB CETVs) represent the cash amount that the scheme trustees are prepared to pay in exchange for members giving up their entitlement to guaranteed benefits. The assumptions underlying the CETVs are set by the trustees of each scheme. There are numerous, scheme-specific factors that affect DB CETVs. However, in broad terms, as the cost of securing a guaranteed return or income rises, as occurs when gilt yields fall, CETVs in general tend to rise. Conversely, when interest rates and gilt yields rise, as has happened recently, the cost of providing a guaranteed income also falls, as do defined benefit CETVs.

This can have a dramatic impact on finances in divorce cases, especially when there are significant changes to interest rates in a relatively short period of time.

There has been a prolonged period of historically high CETVs, starting with a spike immediately after the surprise results of the Brexit vote, which prompted market expectations of falling interest rates and, as a result, falls in medium-term gilt yields and rises in CETVs.

However, the situation has changed rapidly over the last year and since Liz Truss’ ‘mini budget’ in September 2022 in particular.

We have seen one case where a DB CETV fell from £2.1m to £1.1m over the period of a year, during which divorce negotiations were continuing and another where the CETV fell from £1.6m to £1m. Not all cases are so extreme, but falls of around 30% over a few months have become quite common.

Until recently, we were seeing CETVs which in some cases were 40 times the gross annual income. In other words, for giving up a guaranteed income of £10,000 gross per annum, some schemes offered to pay £400,000, or even more, as cash into a money purchase pension. The highest multiple we saw was 72 times the gross annual income, although that was an exceptional case. We have recently seen a scheme offer a CETV of only 13.4 times the gross annual income, which is lower than we have seen for many years.

The CETV calculation basis varies from scheme to scheme, so it can be misleading to assume anything about any specific case, but it can be helpful to be mindful of the general trends.

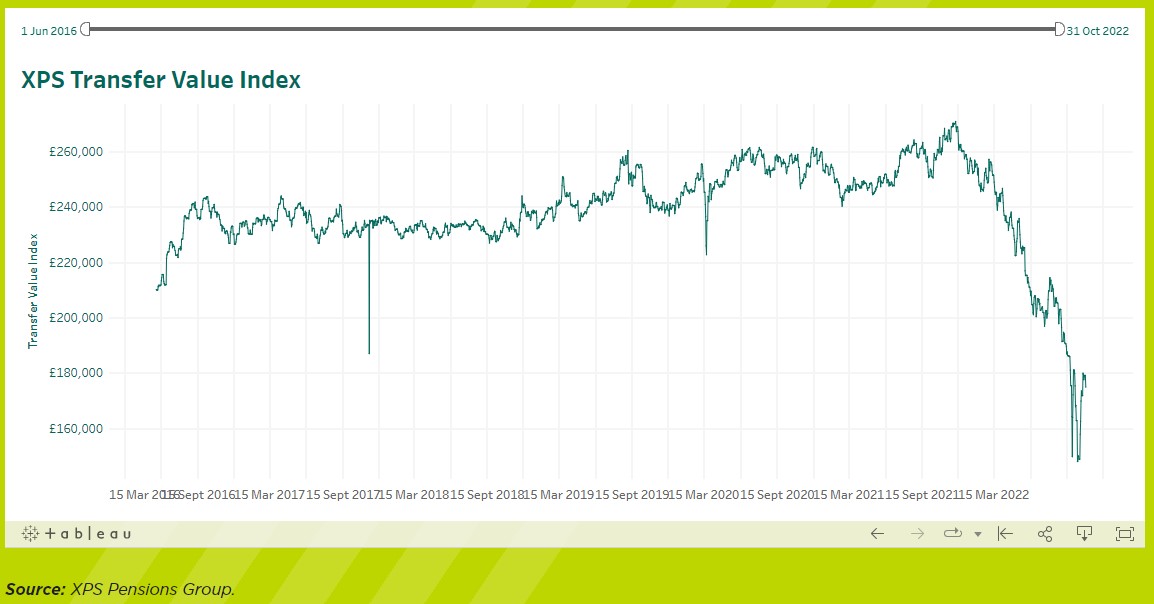

XPS provide an index which represents the average transfer values for schemes it administers for a member at age 64 with a retirement age of 65. This is not necessarily indicative of the entire market, and every scheme is different, but it does provide a stark visual representation of the potential movement in CETVs over a short period (see Figure 1).

Figure 1: XPS Transfer Value Index. Source: XPS Pensions Group.

In the context of sharing a pension on divorce, falls in CETVs between the date the value is obtained for any pension sharing calculations and the date of implementation can lead to the recipient of the pension credit receiving a significantly smaller cash payment than expected. The experience of 2022 when gilt yields and expectations changed so rapidly is a useful reminder that in many cases it is prudent to update any pension sharing calculations shortly before going to court to get a pension sharing order.

As already outlined, the last two decades have delivered consistently high returns for passive holders of 60% equity/40% bond portfolios, driven largely by the nature of the macro-economic environment.

After an extended period of quantitative easing and ‘over earning’ from investments, it was reasonable to expect lower real returns ahead, but the re-set in 2022 proved to be more dramatic and rapid than anticipated. The good news is that a considerable adjustment in both interest rates and interest rate expectations is most likely behind us and in selected bond and equity investments investors can now be ‘paid to wait’ for the macroeconomic mists to clear without taking on huge levels of risk.

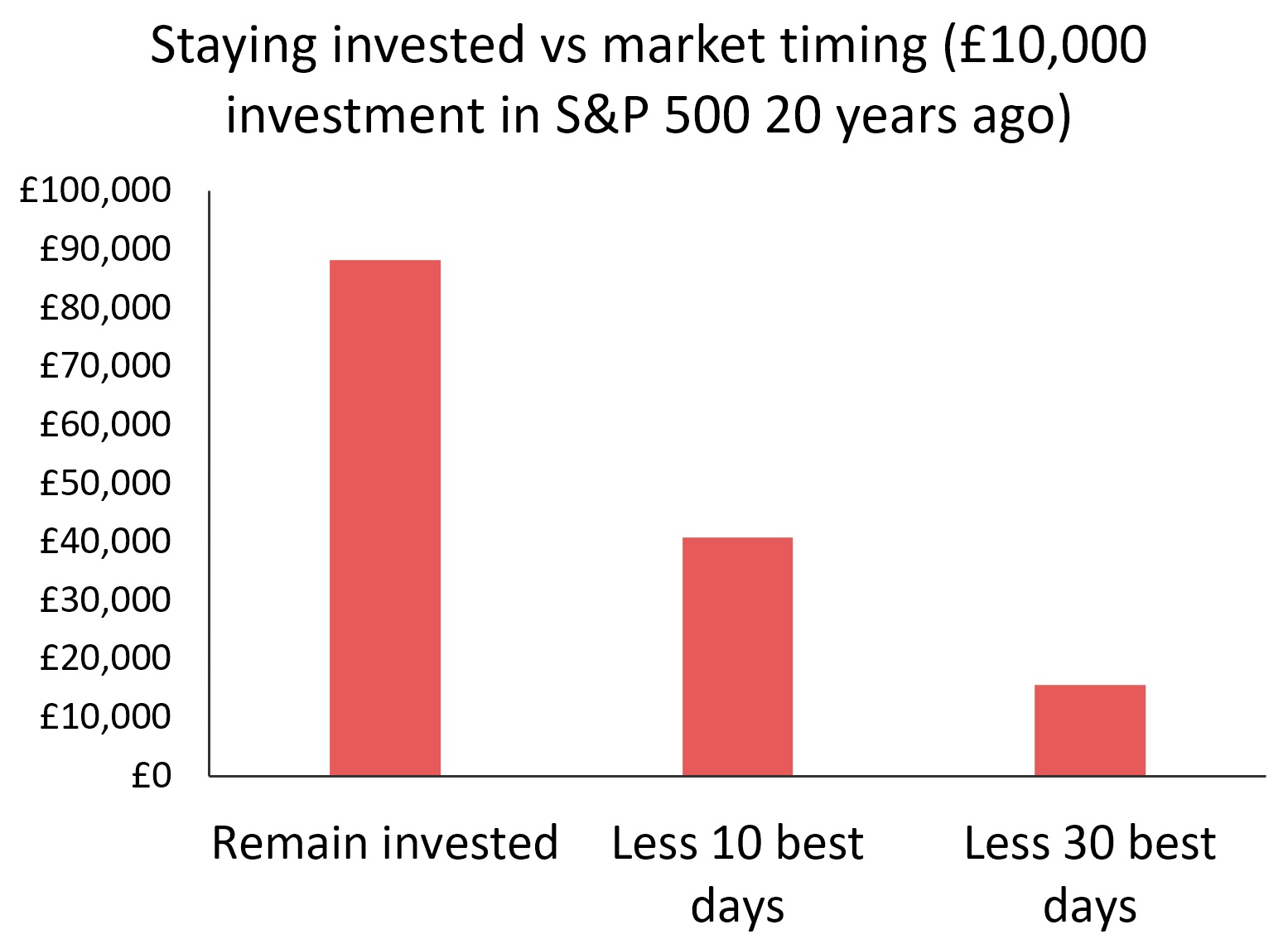

Attempting to time when to get in and out of investments is tricky, and impossible to do consistently, but catching the rebound helps. Staying invested in the S&P 500 for the past two decades would have delivered annualised returns of 9.76%. Assuming that the 10 best days were missed from that 20-year period, the annualised return falls to 5.6% and missing the 30 best days cuts it further, as shown in Figure 2.

Figure 2: Staying invested vs market timing (£10,000 investment in S&P 500 20 years ago)Source: Refinitiv/Evelyn Partners. Data as at May 2022.

In the context of divorce negotiations, the question many solicitors will be asking is whether to obtain updated pension valuations and request revised pension sharing calculations before implementing a settlement. When advising the party receiving a Pension Credit, it might seem at first that it is fundamental to do so, as they may well receive a far lower cash amount than expected.

However, there isn’t a simple answer to this question that is true for all cases. This is because, whilst valuations have fallen, the cost of generating a guaranteed income has also fallen, and in some cases revised calculations will result in a relatively modest change to the pension sharing percentage, or even the percentage share for the recipient falling rather than rising (as might be expected).

If solicitors do request updated calculations without guidance from a pension and divorce specialist, we would suggest that they manage their client’s expectations by explaining that the pension sharing percentage could fall, depending on the actuarial assumptions, and the purpose of the update is to reduce the risk of an unfair settlement, rather than to improve upon the existing percentage.

Like with most pension considerations in divorce, there are various exceptions and caveats, and we would always advise proceeding with caution.

Important information

This article is solely for professional advisers and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this commentary is accurate and up to date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. Investments carry risk – you may get back less than the amount invested. Past performance is not a guide to future performance.