Money Corner: All A Bit Unnecessary

Published: 30/06/2025 06:00

‘Tax doesn’t have to be taxing’ was the slogan that HMRC used 20 years ago to raise awareness about the system of Self-Assessment, but some of the recent developments around tax and divorce have me scratching my head about this maxim.

No gain no loss transfers and the former matrimonial home

As most family practitioners are no doubt aware, since 6 April 2023, no gain, no loss (NGNL) transfers apply to a much longer period than was previously the case.

Ironically, where the former matrimonial home (FHM) is concerned, this extension appears to have made the position worse than it was before where one spouse is transferring a share of the property to the other. This is because the NGNL treatment takes precedence and there is no way to opt out of it.

Capital gains tax (CGT) principal private residence (PPR) relief interacts with NGNL transfers in such a way that the recipient of an NGNL transfer inherits the transferor spouse’s ownership period and occupation history. In other words, if an absent spouse transfers their share of the FMH to the recipient spouse, the latter picks up the absent spouse’s period of non-occupation and will not receive full PPR relief on an eventual disposal even if they have lived in the property throughout their period of ownership.

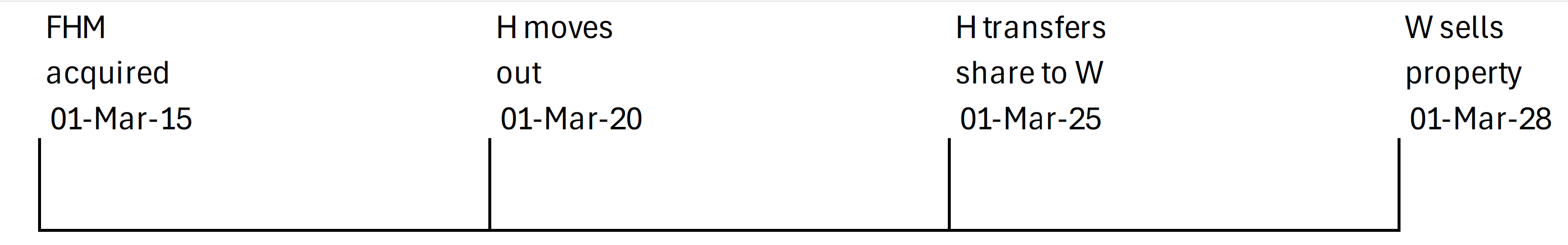

By way of an example, Figure 1 illustrates a timeline for a property owned 50:50 between husband (H) and wife (W). In the Figure 1 example, H has not been resident in the property for 5 years. His share of the property is transferred on divorce to W under an NGNL transfer.

Figure 1

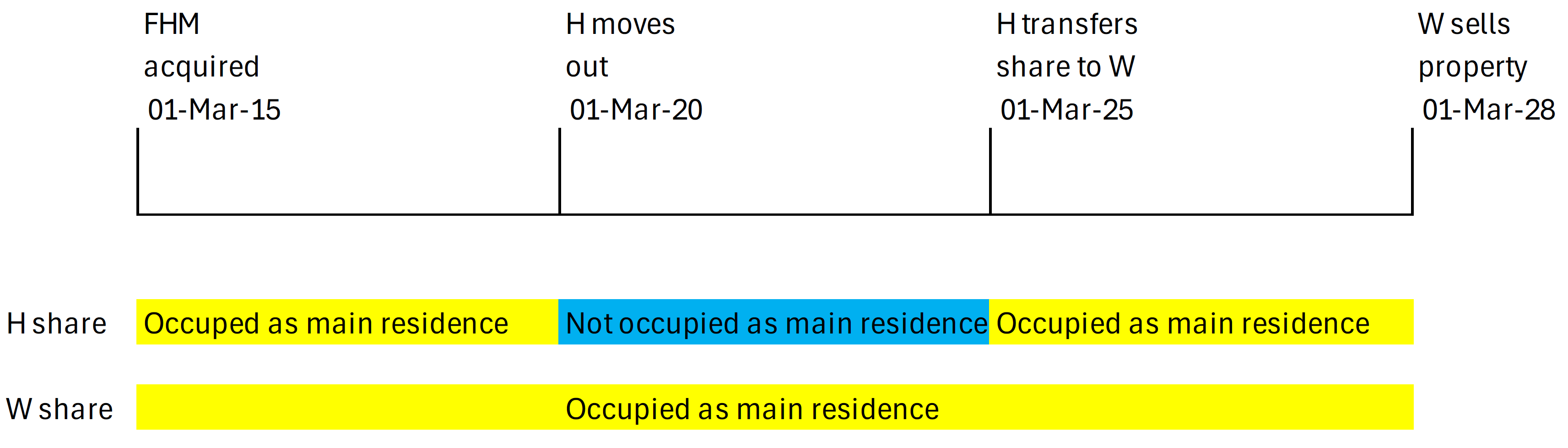

When W sells the property 3 years later, her PPR relief claim is based on the occupation periods in Figure 2. Working this out on a proportional basis, W only receives PPR relief on 21/26th of the gain and the remaining 5/26th of the gain will be taxable (as a result of her inheriting the H’s period of non-occupation).

Figure 2

The situation was different prior to 6 April 2023. Before the NGNL period was extended, a transfer between spouses on divorce and outside the tax year of separation fell within s 225B Taxation and Capital Gains Act 1992 (TCGA 1992), which extended the period of deemed occupation if certain conditions were met. The recipient spouse would receive the transferred share of the property at its market value at the date of transfer and without inheriting any period of non-occupation.

I suspect that this is an unintended consequence of the extension of NGNL. It is important that family practitioners are alive to this issue so that they can make clients aware of the risk of potential CGT liabilities. Indemnities from the transferring spouse may well be appropriate and I am starting to receive instructions to provide tax advice on how to structure indemnities to cover potential future CGT liabilities.

Importantly, recipient spouses who have not been properly advised of their potential CGT liabilities could well assume (wrongly) that the sale of their home was tax-free. If they were then to fail to make the appropriate disclosures to HMRC and to fail to file correct tax returns, they would be liable to interest and penalties.

In addition, all this means that the cost of divorces is rising, which was the opposite of HMRC’s stated intention. For that reason, steps are being taken to lobby for a change in the rules, but while they remain as they are, it is vital that clients are given appropriate warnings.

Court orders for future capital sums

Such lobbying can be successful, as was demonstrated when the cat was set amongst the proverbial pigeons at the end of last year, when a change to an entry in HMRC’s manuals was spotted.

On 8 October 2024, HMRC updated its CGT manual paragraph CG65334. This paragraph sets out HMRC’s opinion in relation to PPR relief and the effect of court action. The old version of the paragraph included an example where the court had ordered that the wife be given one-third of the sales proceeds from the disposal of the FMH which was owned solely by the husband. In the numeric example, one-third equated to £53,000. In the old version of the paragraph, this was HMRC’s position:

‘Mrs D is not chargeable to Capital Gains Tax on the £53,000 she has received. It represents financial provision for her ordered by the Court and is not a sum received in consideration for the disposal of an asset.’1

The amended paragraph now reads as follows:

‘Mrs D is chargeable to Capital Gains Tax on the £53,000 she has received. Although it represents financial provision for her ordered by the Court it is also a capital sum derived from an asset (which in this case is the right to 1/3 of the proceeds of sale), see CG12940.’2

Once our heartrates had settled and returned to only double digits, we started to consider the potential ramifications of this change, including its implications on settlements currently being negotiated and on existing court orders. Needless to say, we were concerned about the unreasonableness of, in this example, taxing over 100% of the sale proceeds.

If you take this manual as it stands, if you have a situation where a court order provides for the wife to receive 50% of the sale proceeds of a property owned solely by the husband, he would pay CGT on any gain made on the disposal of his 100% share of the property, without a deduction for the payment made to the wife. In addition, the wife would be subject to CGT on the 50% share of the sale proceeds she receives, with no deduction.

Putting some numbers to this, if the property was originally acquired for £600,000 and is sold for £1m, ignoring incidental costs of sale and purchase, the husband would pay CGT on a gain of £400,000 (being £1m less the purchase cost of £600,000) and the wife would pay CGT on £500,000 (being 50% of the sale proceeds). Consequently, a sum of £1.5m would be subject to CGT as proceeds, or 150% of the sum actually received for the sale of the property.

There is, however, good news to report. Resolution has raised this issue with HMRC, which has confirmed that this amendment was incorrect and does not accord with HMRC’s view. This amendment was made on 7 May 2025. The example has been changed to confirm that Mrs D is not subject to CGT on the £53,000.