Mltpl: A New Business Valuation Tool

Published: 06/07/2022 07:12

Introduction

Business valuations are often associated with high costs, long delays and, in many instances, subjective analysis and unsupported conclusions. Inevitably, questions arise as to their utility, given their inherent fragility.

It does not have to be this way. Mltpl is a new automated business valuation software that uses cutting edge and market leading technology to produce accurate and reliable valuation reports at the click of a button. Reports that are generated in minutes, not months.

In this article, we provide an overview of Mltpl: how it works, its demonstrated ability to outperform other valuation methods and the exciting potential for its use in family law cases. Specifically, we discuss:

- the market approach, a common valuation method adopted in financial remedy proceedings, and the necessary steps that should be taken, but are all too often overlooked, when performing reliable analysis;

- the approach that Mltpl adopts when performing its valuation analysis, including a description of the machine learning methods that it employs to analyse upwards of 30,000 pieces of relevant financial information;

- the extensive testing that the Mltpl team has performed, consistently providing the assurance that Mltpl performs in line with the views of other experts, and often outperforms the methods they commonly adopt; and

- the exciting possibilities that Mltpl creates for valuations performed in family law cases, from providing an accurate indication of the value of a business asset at the very beginning of the disclosure process, to crosschecking representations made during proceedings, allowing for efficient and effective historical valuations to be performed instantaneously.

Business valuation: what good looks like

The most common valuation method adopted in financial remedy proceedings is the market approach. As summarised in the International Valuation Standards (IVS), an authoritative text published by the International Valuation Standards Council (IVSC),1 the market approach relies upon a comparison being made between the subject company that is being valued to other sufficiently comparable businesses for which price information is available.

Using this approach, valuations are performed by reference to valuation multiples such as Enterprise Value (EV) to Earnings before interest, tax, depreciation and amortisation (EBITDA),2 where the EV/EBITDA multiple is assessed by reference to the observable EV/EBITDA multiples of other listed companies. They key issue here, however, is ensuring that the EV/EBITDA multiples of the other ‘comparables’ upon which the calculation is performed are for companies which are sufficiently similar to the subject company being valued. Such analysis can be performed in a variety of ways, but the starting point should always be a clear and objective set of criteria to identify a group of potential peer comparables, by reference to, say, geography, industry and size.

Despite the clear guidance provided in the IVS (and other valuation texts), many valuers give scant evidence or analysis for their choice of multiple. Unsubstantiated comments such as ‘in my experience’ and ‘multiples typically trade at between X and Y’ are commonplace, and frequently lack any underlying analysis. Indeed, it is rare to see a discussion of the factors which valuation theory states are critical to the assessment and calculation of a valuation multiple, such as profitability, size and growth.

This is particularly surprising given the effect that the valuation multiple has on any market approach valuation. By way of example, a valuation multiple of, say, 5x, assessed by reference to the expert’s ‘experience’, as compared to a valuation multiple of, say, 7.5x, estimated by reference to peer comparables and comparisons of growth, profitability and size, leads to a difference of 50% in the assessed EV.

The next step in performing a market approach valuation is the application of the valuation multiple to a corresponding earnings figure. In the case of an EV/EBITDA multiple, one would multiply the EV/EBITDA multiple by an assessment of the subject company’s EBITDA to calculate an EV. However, unlike with the calculation of a reliable valuation multiple, many of the adjustments required when assessing a business’ maintainable EBITDA are subjective and easy to adjust for. Indeed, it is common for arguments to arise over whether a percentage adjustment should be made to a company’s earnings figure to reflect issues of past performance or expected future performance.

Fortunately, the mathematical mechanics of such adjustments are straightforward, and, armed with the relevant starting figures, legal teams and counsel are well placed to make any required adjustments when performing a valuation calculation. And that is exactly the position that Mltpl places its users in, by providing a robust and accurate assessment of a contemporaneous valuation multiple, as at the relevant valuation date, and an initial estimate of maintainable EBITDA, based on recent historical financial performance.

Algorithmic consistency, assured objectivity

In contrast to the vague and noisy approaches that are sometimes adopted by valuation experts, Mltpl ensures algorithmic consistency, time and time again. In fact, when an Mltpl report is requested, Mltpl’s technology actually runs nine separate valuations. These include valuations based upon the factors outlined above in respect of the key determinants of an accurate valuation multiple by reference to valuation theory, but also the valuation multiples of other comparable businesses by reference to the subject company’s industry.

Then, in addition, to these methods, Mltpl employs cutting edge artificial intelligence and machine learning methods to analyse vast quantities of relevant financial data to fit otherwise unspotted patterns to the observed valuation multiples of listed businesses. In other words, Mltpl allows for empirical observations to be made in a robust and repeatable manner to the data of thousands of listed companies and then applies these to the subject company being valued, based on its own specific circumstances and financial performance. This novel approach allows for Mltpl to gain insights far beyond the conventional approach to valuation analysis.

The next step in Mltpl’s analytical journey is the application of continually refined weightings to the nine separate valuations it performs, allowing for an accurate overall prediction to be made of an appropriate valuation multiple for the subject company, consistent with valuation theory and large amounts of data analysis. As we discuss in further detail below, this approach allows for the Mltpl team, via its continuous and extensive testing of Mltpl’s technology, to refine gradually the weightings it adopts to ensure that Mltpl’s predictive power is always optimised.

Perhaps best of all, not only is Mltpl’s valuation approach both reliable and accurate, but it also offers guaranteed objectivity. There is no switch to tell Mltpl to perform a valuation for either husband or wife. The valuation is performed in exactly the same way, with the same assumptions being made, regardless of which party requests the report. This factor cannot be overlooked, as many of you will have first-hand experience of valuations performed solely for the purpose of litigation, prepared either by the business owner’s accountant or internal management team with questionable assumptions. Mltpl cuts through all of this. It is completely impartial.

Testing like never before

It should be emphasised that the valuation of private companies is a difficult and challenging task, in part because the aim is to estimate an unobservable quantity. While the valuation of shares in a publicly listed company is elementary, one simply observes the share price and that is the answer, no such index exists for private companies and suitable valuation approaches, such as those as summarised above, are therefore required.

However, and as a consequence, it is also difficult to assess the reliability of valuations performed by business valuers. Indeed, the ‘acid test’, as referred to by Lewison LJ in Versteegh v Versteegh [2018] EWCA Civ 1050, [185], is for the subject company to be exposed to the ‘real’ (i.e. open) market and sold. Yet such an approach is, for obvious reasons, impractical and rarely seen. This is not the case for Mltpl, as its technology allows for it to be tested extensively against thousands of listed companies on a regular basis and for its performance to be assessed.

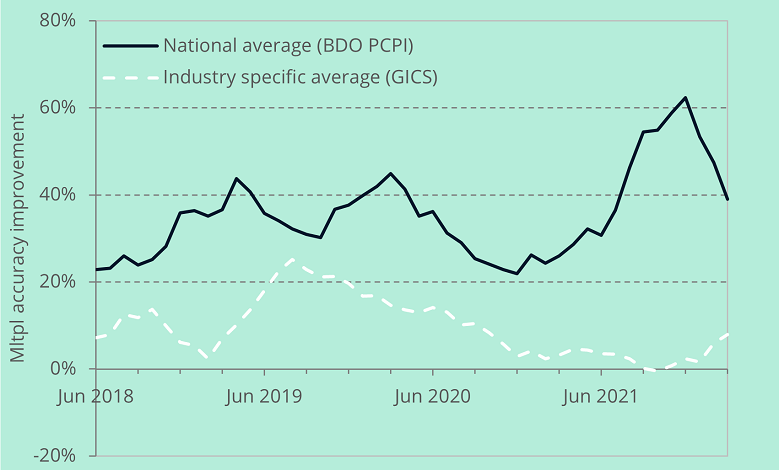

To put this in context, Mltpl is tested monthly against two valuation methods commonly adopted by other valuation experts. Mltpl has, for a period of over 2 years, consistently outperformed these approaches, often to a large degree. The accuracy improvement over these other methods is shown in Figure 1.

Figure 1: Mltpl accuracy improvement, compared to other valuation approaches

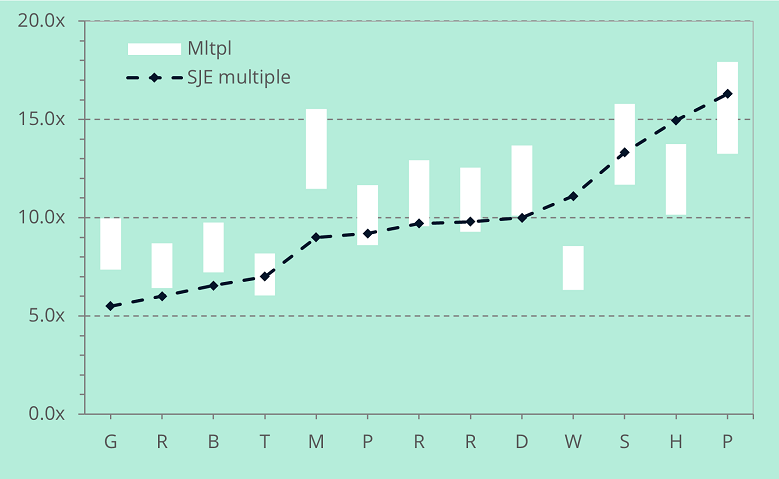

In addition to this comprehensive testing against observable, empirical data, Mtlpl has also been demonstrated to perform in line with valuations performed by other valuers. This is summarised in Figure 2, which shows the valuation multiple range predicted by Mltpl (the white bars) and the valuation multiple adopted by the valuer (the blue line) in 13 (anonymised) cases.

Figure 2: Comparison of Mltpl to anonymised expert valuation reports

As Figure 2 shows, Mltpl regularly performs in line with the valuation conclusions reached by the human valuer. The difference being that Mltpl does so instantaneously and at a fraction of the price, as compared to the 3 months and multi-thousand pound fee for the human valuation. However, Figure 2 also highlights that Mltpl does not always agree with human valuers. We do not consider this to be a deterrent to its use, but rather a reflection of the myriad purposes for which valuations are performed, as well as their associated quality.

By way of example, in case ‘M’ in Figure 2, the valuation disclosed by the business owning party was prepared by their own accountant, and contained material flaws in the valuation method adopted. It is, therefore, perhaps unsurprising that the resulting valuation was lower than what would otherwise have been assessed, as illustrated by the prediction made by Mltpl of a significantly higher valuation multiple.

Likewise, when comparing the associated costs of the 13 valuations analysed in Figure 2 with the conclusions reached, we observe that, in many instances, the reports for which the costs are the lowest (i.e. less than £5,000) diverge most greatly from the predictions made by Mltpl. As we note above, we consider Mltpl’s consistent application of an objective methodology to be a huge source of assurance for the benefits offered by Mltpl.

Mltpl, a significant step towards efficient and cost-effective litigation

The benefits of rapid and reliable business valuations in financial remedy proceedings are obvious and apparent. You do not have to cast your mind back far to remember a time when expensive accountants were instructed to perform maintenance capitalisation calculations using Duxbury tables. Whereas now, automated Capitalise calculations are universally accepted when estimating a lump sum referable to a given level of income and a set period of time. Mltpl offers a similar advancement for family law cases, where a business valuation is required.

Its application to financial remedy cases need not stop there, however. Mltpl’s ability to instantaneously deliver accurate and reliable estimates of a business value opens a number of new avenues for how its output can be used, for example:

- providing robust support for an estimate given in a Form E;

- as a cross check of representations made by the other side in respect of their views on a business value; or

- as an initial estimate with which the parties can begin negotiations and progress the case, without any of the delay previously associated with directions at first appointment, including instructing a single joint expert, the time taken for them to request information, arguments about what information can be shared, and the costs attaching to all associated correspondence.

Mltpl also provides a helpful hand to many of the pragmatic approaches adopted by the Family Court to assess a value that is fair for a company at some time in the past. Specifically, Mltpl’s technology allows for a historical valuation to be performed at any point in the past, subject to the availability of data, thus allowing for an efficient and cost effective estimate to be made that avoids any valuation theory ‘heresy’ (see E v L [2021] EWFC 60 (Fam), [56]) which can be added to the cannon of available evidence when assessing how to divide up any matrimonial accrual over the course of a relationship.

Fundamentally, Mltpl allows for all parties throughout the process, and right from day one, to be empowered with the knowledge that an accurate and reliable valuation estimate provides. The days of delay and unnecessary costs are over.

Conclusion

In short, Mltpl provides high quality and reliable business valuation reports instantaneously and it is our hope that Mltpl can, finally, see an end to ‘arid, abstruse and expensive black-letter accountancy valuations’ in financial remedy proceedings (WM v HM [2017] EWFC 25, [16]).