Market Turbulence and Cash Equivalent Values (CEVs) for Defined Benefit Pensions, Q3 2022

Published: 10/10/2022 08:52

There has been much publicity and comment about rising gilt yields following the “mini budget” statement. One of the consequences of rises in gilt yields, is that with all other things being equal, Cash Equivalent Values reduce. In other words, there is an inverse correlation between gilt yields and transfer values.

In order to keep this paper both short and practical, I will not go into the technical reasons as to why gilt yields have increased, and why this forces CEVs down, nor will I discuss the other factor at play of LDIs (Liability Driven Investment strategies) within pension schemes – there is much material on the internet if you are so inclined.

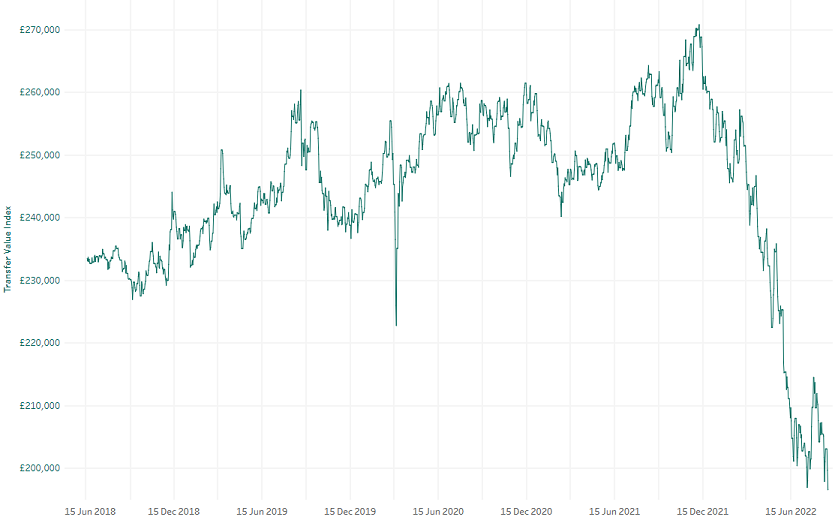

What is important to understand is that the fall in CEVs is not just post the mini-budget, they have been falling since the start of the year, as shown by the following graph1 (courtesy of XPS Pensions).

In effect, it is very likely that if you have a CEV for a case which is only 3 or 4 months old (which hitherto most of us would not count as overly historic) it will have fallen and will be out of date. The following is our thought process here:

- Paralysis of Divorce settlements caused by uncertainty of CEVs is not a practical option. However, there may be occasions where matters are outside out control, for example schemes may suspend CEV quotes whilst they review their CEV calculation basis. We would expect this though to be the exception and not the rule.

- At the moment, Public Sector CEVs have not been affected.

- CEVs of DC funds may have changed in line with markets (which is different to the change in DB schemes) but obtaining new DC CEVs is usually not a delay-inducing issue.

- Obtaining a new DB CEV if one has been issued in last 12 months usually comes at a cost.

- Ask yourself if you really do need a brand new CEV now, at this juncture in your case? If the matter is still some months away from settling, whether you have a May 2022 or an October 2022 CEV is not the issue, what is the issue is the prevailing CEV when you settle.

- Consider the proportionality of the pension in question. If you have a private sector DB CEV of £100k but also in the same case a public sector CEV of £500k (which we know has not changed) then it is perhaps not proportionate to worry about any change in the private sector DB CEV.

- Further, if the outcome sought is equality of income, the only DB CEVs that are used in calculations is the CEV of the DB scheme which is being shared. None of the other CEVs of DB schemes in a case is relevant for the equality of income calculations.

- If the outcome sought is equality of pension capital, in general, the CEVs of private sector DB pensions are not used in the calculations. We use a single set of assumptions to value the underlying pension benefits on a given day. This allows for a like-for-like comparison of pension capital between the various pension arrangements.

- All of our reports state that the calculations are only indicative, and in recognising that there is often a delay between the production of our report and the settlement of a case, we suggest that it is sensible to obtain a new CEV close to the time of settlement, allowing us then to fine tune the calculations.

The sudden and material reduction in CEVs for private sector DB schemes also highlights the fallacy of using CEVs as a guide to the value of a pension for offsetting purposes. If H has a deferred pension of £10,000 pa payable at age 65, it cannot be right that if you were going to offset this pension, W would have received £270,000 had you settled in December 2021, but now should receive less than £200,000 (figures subject to adjustment for tax/utility). H’s pension has not changed; he is still going to receive £10,000 pa.

Summary

We will continue to write reports with the CEVs with which we have been provided, unless in our opinion they are too out of date and of such a relative size to other pensions in a case that the possibility of a serious deterioration in value cannot be ignored. That is a call we will make once instructed and upon receipt of the relevant data.

More of our reports may need fine tuning, and we will emphasise the need for this, but it is very rare that upon such fine tuning, the actual recommendations as to which pension should be shared, or the construct of the settlement changes – all that changes usually is the percentage of the pension to be shared. The greater the value of the other (not to be shared) pensions in a case, the more diluted the effect of a change in CEV becomes.

Offsetting calculations, where we very rarely for DB schemes advocate the use of CEVs as a measure of value, will not be expected to change just because CEVs have changed.

Finally, does a significant reduction in the CEV in a pension captured by an executory pension sharing order leave open the possibility of an appeal under Barder or Thwaite? That’s a legal matter and thankfully outside my area of expertise.