Apportioning Pension Assets to the Marital Period in Divorce

Published: 01/05/2025 13:00

Dividing pension assets is critical for a fair divorce settlement. This summary focuses on pension sharing, the legal splitting of pension rights between divorcing parties via a Pension Sharing Order, applicable in England and Wales. It excludes offsetting and combination approaches and also omits jurisdictions outside England and Wales, such as Scotland where the apportioning of pension rights is defined very prescriptively by Scots Law, with little scope for discretion.

Legal context and discretion

Courts generally consider the total value of pension rights up to the settlement date, excluding future accruals. However, a common debate is whether to exclude (or ‘ringfence’) pension rights earned:

- before cohabitation;

- after separation;

- both before cohabitation and after separation.

This can have a significant impact in short marriages or when pension accruals span lengthy careers. The court’s approach depends on whether the case is needs-based (assets do not exceed needs) or sharing-based (assets exceed needs). Ringfencing is generally discouraged in needs-based cases but may be appropriate in sharing-based ones.

Courts have wide discretion under s 25 of the Matrimonial Causes Act 1973, requiring a detailed analysis of financial needs, income, and retirement provisions. Specialist legal advice is often needed, as it is not always clear how sympathetic the court will be to ringfencing (‘apportionment’) arguments.

Types of pension assets and apportionment approaches

a) Defined Contribution (DC) Pensions

DC pensions consist of funds derived from individual and employer contributions. Apportionment usually involves:

- historical data of contributions during the marital period;

- adjustments for investment growth;

- complexities with transfers-in from other schemes as, even if these were received during the marital period, the transferred-in benefits may have been built up from contributions made both during and outside of the marital period.

A Pensions on Divorce Expert (PODE) often estimates the marital portion. Anomalies such as large post-separation contributions due to business success achieved during the marriage may justify including post-separation accruals.

b) State Pensions

The UK State Pension is based on National Insurance (NI) contributions. To apportion their entitlements to the marital period:

- both parties would provide details of their NI records and State Pension forecasts;

- qualifying years of NI credits in the marital period are compared against total qualifying years of NI credits overall.

Issues arise when individuals reach the 35-year cap early, continuing to pay NI without additional benefit accrual. PODEs must apply judgment here.

c) Defined Benefit (DB) Pensions

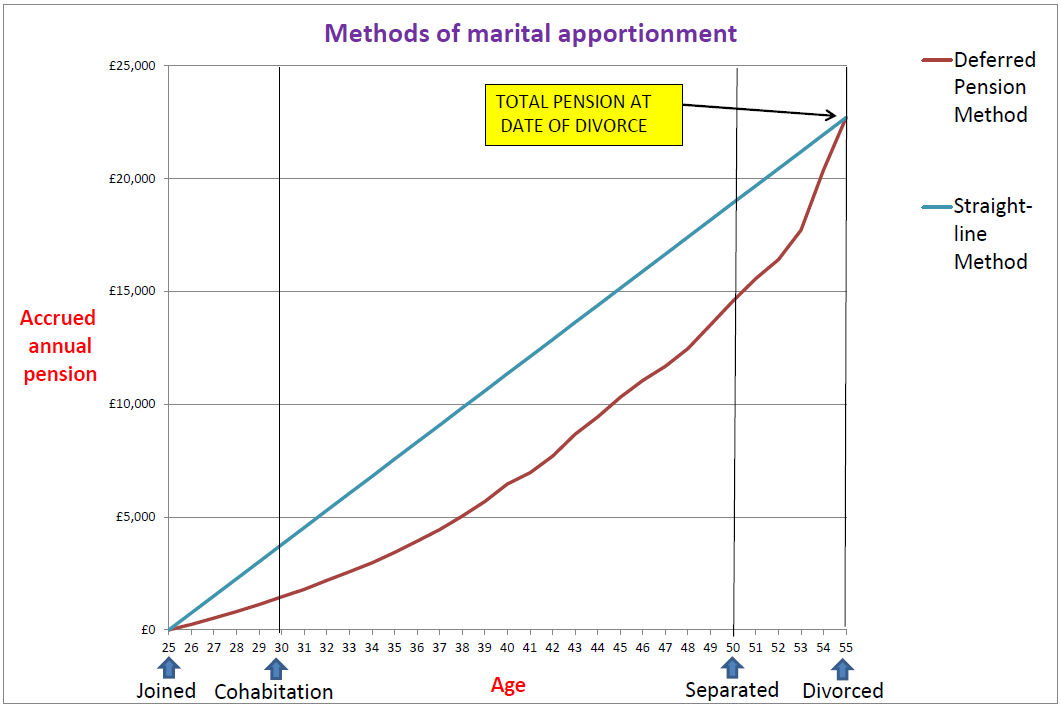

DB schemes offer retirement income based on salary and service. The two main apportionment methods are:

Straight-line method

Marital proportion = A/B

Where A = marital years of service (from date of cohabitation to date of separation)

B = total service in years

This method takes a more simplistic approach, by assuming that each year of service accrues the same amount of pension for the member and so takes no account of the history of salary increases and whether these were earned during or outside of the marital period.

Deferred pension method

Marital proportion = (D-C)/E

Where:

- E = total pension at valuation date

- C = pension at cohabitation date (revalued to the valuation date)

- D = pension at separation date (revalued to the valuation date)

This method looks at the actual pension accrued at each key date (date of cohabitation and date of separation) by reference to actual service and salary at that time. It then compares the accrued pension at that date (plus revaluation to the current time as if the member left service at that date) to the overall pension at the current time.

Each method yields different outcomes depending on salary progression and chosen marital period.

- Straight-line: Easier to calculate and simpler to understand, but can sometimes give arguably unfair results where the pattern of salary progression outside of the marital period is materially different to that within the marital period.

- Deferred: More difficult to calculate and a little harder to understand, but could be argued to be more ‘accurate’ as it better reflects the actual build-up of pension benefit over the period of time the parties were living together.

If salary growth exactly matches price inflation over the entire period of membership of the scheme, and deferred benefits are revalued in line with price inflation, it would usually be expected that both methods will yield near identical results for ‘final salary’ DB schemes. For ‘average salary’ DB schemes – sometimes called Career Averaged Revalued Earnings (CARE) Schemes – the revaluation of benefits for an ‘active contributing member’ may differ from the revaluation of benefits for a ‘deferred member’ who has left service, so the outcome may be different.

If salary growth has exceeded price inflation over the period of membership of the scheme, the straight-line method assumes that benefits are building up at a faster rate, as it assumes that the salary growth achieved over the entire period to the present date is applied uniformly each year, hence no matter when you are assumed to have left service in the past, you will always receive the full proportion of your salary growth had you remained in service to the present time.

If benefits build up faster using the straight-line method, this will have consequences if we are using different methods of apportionment and either excluding the benefits at the start of the period (that is, excluding pre-cohabitation accrual) or excluding benefits at the end of the period (that is, excluding post-separation accrual).

Taking this a step further, if you are excluding pre-cohabitation accrual, and accrual of benefits to the date of cohabitation is higher under the straight-line method, then excluding these benefits means there is less in the remaining pot to be divided up, which is better for the member who is having to share these remaining rights.

Similarly, if you are excluding post-separation accrual, and accrual of benefits to the date of separation is higher under the straight-line method, then the ex-spouse is going to do better using this method, as there is more in the remaining pot which is to be divided up.

If you are excluding both pre-marital and post-separation accrual, then which of the parties does best is much harder to predict. The relative respective lengths of the pre-cohabitation and post-separation periods could well have an influencing impact on the results here in terms of which one dominates, favouring one party or the other.

An example of the build-up of pension rights under both methods for a typical final salary scheme, where salary growth has exceeded price inflation, is set out below.

How do you choose between methods 1 and 2?

Choice depends on:

- type of scheme;

- data availability;

- salary history;

- legal strategy (client – member or ex-spouse, whether aiming for fairness or maximising client’s share);

- costs and time constraints. (PODEs may charge more to perform calculations under the deferred pension method due its complexity and these calculations may take longer to finalise given the additional data requirements).

PODE involvement is advised when pension apportionment could be material. However, in cases where earnings growth is believed to be not dissimilar to price inflation, then the differences between the methods may not justify additional PODE analysis.

Conclusion

In summary, apportionment of pension rights is a complex area and if you think that this could be material to ensure the fair treatment of your case, the services of a PODE could certainly be worth considering.

Disclaimer: The views expressed here are the views of the writer only and do not necessarily represent the view of Actuaries for Lawyers. Whilst every effort has been made to ensure the accuracy of the information in this post, it is important to always check the benefit rules with the schemes before making any financial decisions based upon these. Actuaries for Lawyers cannot be held responsible for any losses incurred as a result of relying upon information contained in this post as it does not constitute advice or act as a substitute for providing individual advice in relation to the specifics of a particular case.